Understanding the concepts of simple interest and compound interest is crucial in the realm of finance. Whether you’re managing personal finances or delving into investment opportunities, grasping these principles empowers informed decision-making. In this comprehensive guide, we will explore the definitions, formulas, and practical applications of simple interest and compound interest.

Types of Interest

Interest, in its essence, refers to the cost of borrowing money or the return on investment. There are primarily two types: simple interest and compound interest.

Definition of Compound Interest

Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods. In simpler terms, it’s interest on interest.

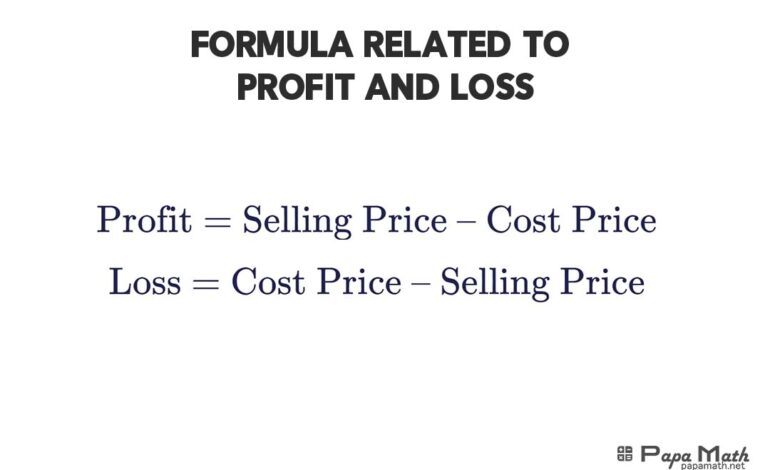

Formula for Compound Interest

The formula for compound interest is:

$$A’=P\left(1+\frac{r}{n}\right )^{nt}$$

Where

A’ = the future value of the investment/loan, including interest

P = the principal investment amount (initial amount of money)

r = the annual interest rate (in decimal)

n = the number of times that interest is compounded per unit t

t = the time the money is invested/borrowed for, in years

Interest Compounded Half-Yearly

When interest is compounded half-yearly, the number of compounding periods doubles, leading to accelerated growth of the investment.

$$A’=P\left(1+\frac{r}{2}\right )^{2t}$$

Interest Compounded Quarterly

Quarterly compounding further intensifies the growth, as interest is calculated and added every three months.

$$A’=P\left(1+\frac{r}{4}\right )^{4t}$$

Interest Compounded Monthly

Monthly compounding takes it a step further, enhancing the effect of compounding by calculating interest each month.

$$A’=P\left(1+\frac{r}{12}\right )^{12t}$$

Compound Annual Growth Rate (CAGR)

CAGR is a measure of the annual growth rate of an investment over a specified time period. It smoothens out the returns and provides a single growth rate that represents the geometric progression.

Simple Interest

Simple interest is the extra money you pay or receive when you borrow or lend a sum of money, calculated as a percentage of the original amount borrowed or lent, typically over a fixed period of time.

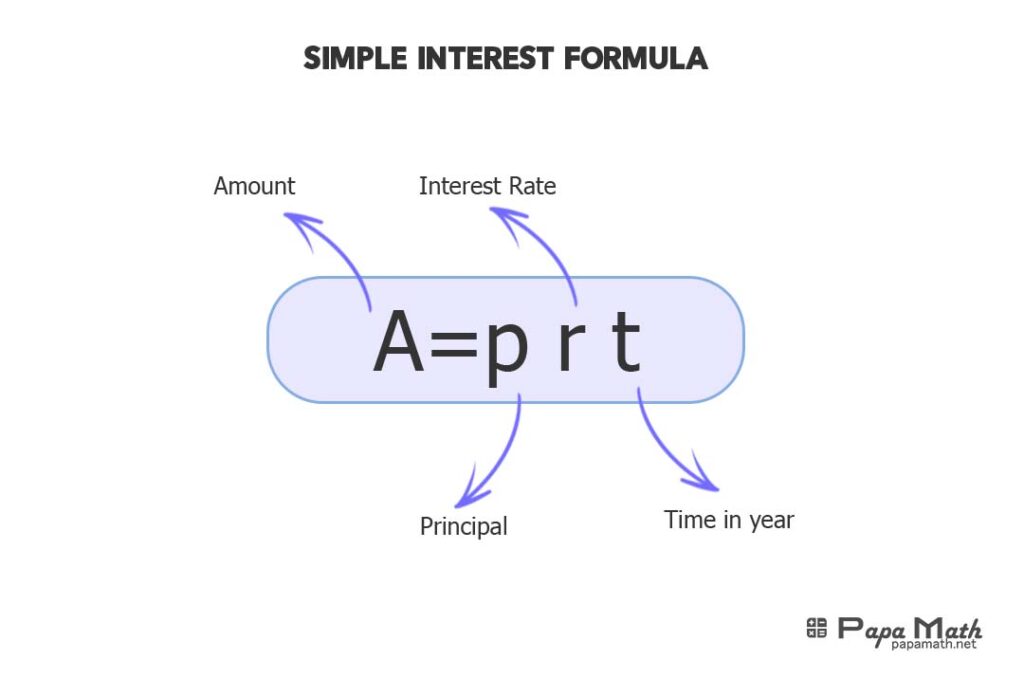

Formula for Simple Interest

Simple interest is calculated using a straightforward formula:

$$A= P\cdot r \cdot t$$

Where:

A=Simple Interest

P = the principal amount (initial investment)

r = the annual interest rate (in decimal)

t = the time the money is invested/borrowed for, in years

Total Amount of Money

The total amount of money, including both principal and interest, can be calculated by adding the simple or compound interest to the principal amount.

$$\text{Total amount of money}=\text{simple or compound interest}+\text{principal amount}$$

How to Calculate Interest?

Calculating interest involves applying the respective formulas for simple or compound interest based on the given parameters of principal, rate, and time.

How Do Teens Benefit From Compound Interest?

Compound interest, with its snowball effect, offers immense benefits to teens starting early on investments. Even small contributions made at a young age can grow substantially over time due to the power of compounding.

What is the Rule of 72?

The Rule of 72 is a simple mental calculation to estimate the time it takes for an investment to double, given a fixed annual rate of interest. It is calculated by dividing 72 by the annual rate of return.

The Bottom Line

Understanding the nuances of simple and compound interest is fundamental for financial literacy. Whether you’re saving for a rainy day or planning for retirement, harnessing the power of interest can pave the way for a financially secure future. By leveraging these formulas and concepts, individuals can make informed decisions to optimize their financial growth and stability.

Difference between Simple and Compound Interest

Here’s a table highlighting the key differences between simple and compound interest table is shown below.

| Aspect | Simple Interest | Compound Interest |

| Definition | Interest is calculated only on the principal amount. | Interest is calculated on both the principal amount and accumulated interest from previous periods. |

| Formula | \(A= P\cdot r \cdot t\) | \(A’=P\left(1+\frac{r}{n}\right )^{nt}\) |

| Principal Growth | Principal amount remains constant. | Principal amount grows over time as interest is reinvested. |

| Interest Growth | Interest remains constant throughout the period. | Interest increases over time due to compounding. |

| Calculation | Simple multiplication of principal, rate, and time. | Involves more complex calculations due to compounding, especially when interest is compounded frequently. |

| Frequency | Interest is calculated once, usually annually. | Can be compounded at various intervals (annually, semi-annually, quarterly, monthly, etc.). |

| Effect on Growth | Growth is linear and steady. | Growth is exponential, accelerating over time. |

| Examples | Savings accounts, certain types of loans (e.g., car loans). | Investments (stocks, bonds, mutual funds), mortgages, most loans. |

Understanding these differences is crucial for making informed financial decisions, whether saving, investing, or borrowing money.

If you want to know about the compound interest factor table click the link and read the detail in the article about the compound interest factor tables.

FAQs

What is simple interest and compound interest?

Simple interest is interest calculated only on the principal amount, while compound interest includes interest calculated on both the principal amount and accumulated interest from previous periods.

What is the difference between SI and CI?

The main difference between simple interest (SI) and compound interest (CI) lies in how interest is calculated: SI is calculated solely on the principal amount, while CI incorporates both the principal and accumulated interest.

What is an example of a simple interest?

An example of simple interest is earning interest on a fixed deposit in a bank, where the interest is calculated only on the initial deposited amount.

What is the difference between simple interest and compound interest formula for 4 years?

The difference between the formulas for simple interest and compound interest for 4 years lies in their calculation approach: \(SI = P × r × t\), \(CI = P × (1 + r)^t – P\).

What is the biggest difference between simple and compound interest?

The biggest difference between simple and compound interest is the growth pattern: Simple interest leads to linear growth, while compound interest results in exponential growth due to reinvestment of interest.

What is an example of a compound interest?

An example of compound interest is investing money in a savings account or a mutual fund, where the interest earned is added to the principal, resulting in compounding growth.

How to calculate simple interest?

To calculate simple interest, multiply the principal amount by the interest rate and the time period.

What is the difference between compound daily and monthly?

Compound daily interest is calculated and added to the principal every day, while compound monthly interest is calculated and added to the principal once a month. The main difference lies in the frequency of compounding, affecting the growth rate of the investment or loan.

“How to calculate average percentage?” is a comprehensive guide outlining various methods and formulas to compute the average of a set of numbers efficiently.

Conclusion

Understanding the dynamics of simple and compound interest is pivotal for financial literacy and prudent decision-making. Whether you’re aiming to fortify your savings or embark on investment ventures, grasping these concepts empowers you to navigate the financial landscape with confidence.

Simple interest, with its straightforward calculation, serves as a foundational principle, while compound interest’s compounding effect unlocks exponential growth potential. By discerning the nuances between them, individuals can tailor their financial strategies to align with their goals.

whether it’s securing a stable future or seizing lucrative investment opportunities. Embracing the power of interest cultivates a path towards financial resilience and prosperity.

Please feel free to ask your query, and I’ll be happy to answer your query.